1. Introduction to Insurance Policies

2. Understanding Project-Based Insurance

3. Exploring Ongoing Program Insurance

4. Evaluating the Scope of Your Projects

5. Budget Considerations

6. Risk Management Strategies

7. Regulatory Compliance

8. Duration and Complexity

9. Customization and Flexibility

10. Collaboration with Stakeholders

11. Industry Trends and Insights

12. How Trust Partners Insurance Can Assist You

1. Introduction to Insurance Policies

🏢 Definition of Insurance Policies

Insurance policies are contracts between an insurer and a policyholder that outline the claims which the insurer is legally required to pay. They play a critical role in managing risks in construction projects. Understanding the types of policies available is crucial for making informed decisions.

💡 Importance of Choosing the Right Insurance

Choosing the right insurance policy ensures protection against potential losses and liabilities. This provides peace of mind and stability, allowing you to focus on project execution without undue stress.

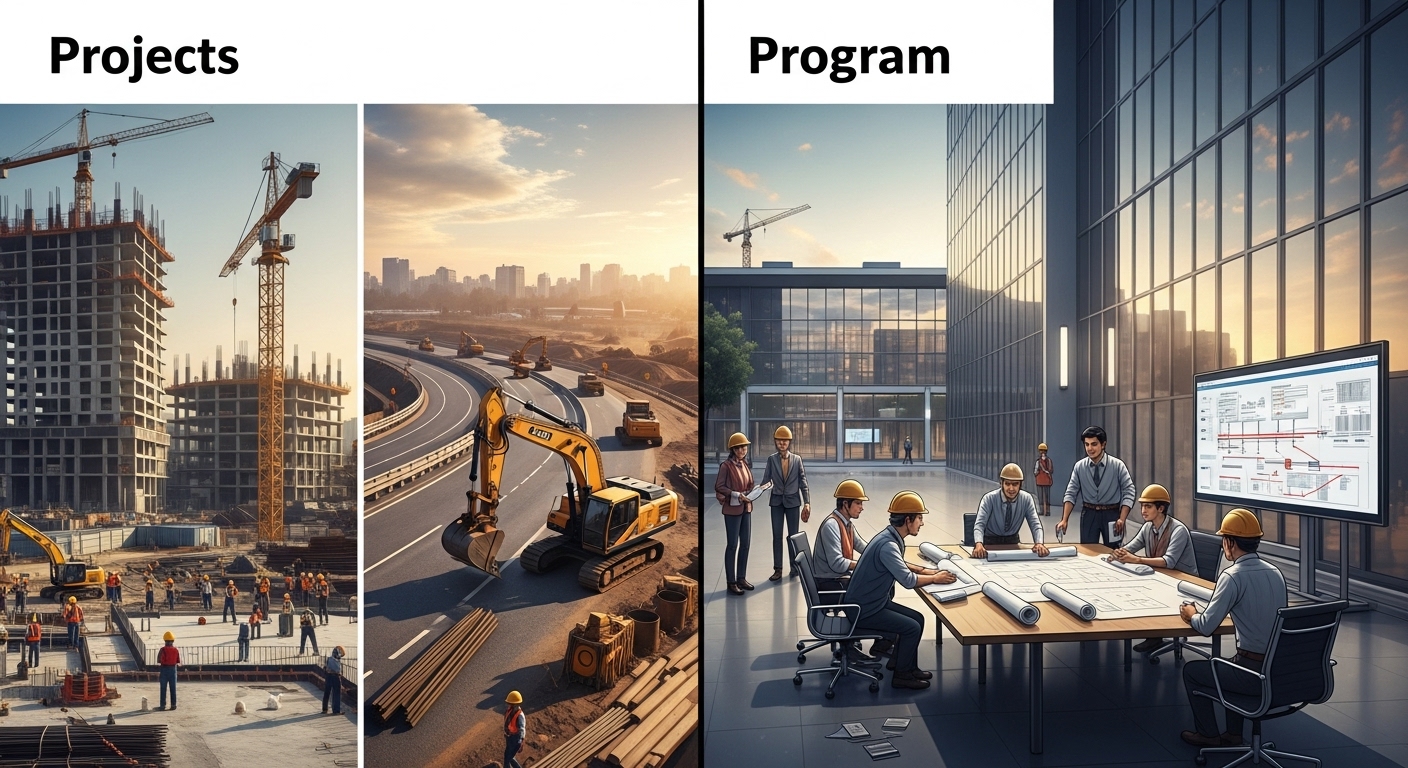

2. Understanding Project-Based Insurance

🔍 What is Project-Based Insurance?

Project-based insurance, also known as “wrap-up” insurance, covers specific construction projects individually. This means that coverage is tailored specifically to the risks and needs of that particular project. For example, building a high-rise might need more stringent coverage than a warehouse.

🏗️ Benefits of Project-Based Insurance

This type of insurance provides comprehensive coverage for a project from start to finish. Specific benefits include more precise risk assessment, tailored policy terms, and potentially lower premiums due to focused risk evaluation.

3. Exploring Ongoing Program Insurance

📈 Overview of Ongoing Program Insurance

Ongoing program insurance, often referred to as “blanket” insurance, provides coverage for all projects a firm undertakes. This type is ideal for companies with numerous small projects requiring consistent coverage, such as multiple residential developments.

🚀 Advantages of Program Insurance

The main advantage of ongoing insurance is the efficiency of having a single policy. It eliminates the need to negotiate insurance for each project, which can save time and administrative costs.

4. Evaluating the Scope of Your Projects

🏢 Analyzing Project Scale and Costs

The size and cost of your projects significantly influence insurance needs. Larger projects with higher budgets might require specific coverage options that a project-based policy can offer.

🔍 Identifying Specific Risk Profiles

Each project carries its own set of risks. For instance, a project in a flood-prone area will have different risk considerations compared to one in a stable climate zone. Analyzing these risks helps in determining the suitable insurance type.

5. Budget Considerations

💡 Cost Implications of Different Policies

Project-based policies might have a higher immediate cost due to their bespoke nature. However, they can lead to cost savings by avoiding over-coverage. Program insurance might seem budget-friendly, but can sometimes lead to unnecessary coverage costs.

📊 Balancing Cost with Coverage

Strike a balance by conducting a thorough cost-benefit analysis. Consider the potential risks and coverage needed against the premium cost to identify the most economically viable option.

6. Risk Management Strategies

🎯 Implementing Effective Risk Assessments

Conducting comprehensive risk assessments allows you to understand potential threats and how they can impact your projects. Tailor your insurance strategy according to these assessments.

📉 Mitigating Risks with Insurance

Use insurance as a tool to transfer risk. For example, ensure clauses in your policy are aligned with identified risks, thus making the insurance an active part of your risk management strategy.

7. Regulatory Compliance

🛡️ Understanding Regulatory Requirements

Different projects may be subject to distinct regulatory standards. Ensuring your insurance policy meets these standards is crucial, as non-compliance can result in legal ramifications and financial penalties.

📜 Collaboration with Legal Experts

Engage with legal experts to review insurance requirements. They can provide valuable insights into regulations and how different insurance policies meet these stipulations.

8. Duration and Complexity

⏳ Evaluating Project Timelines

The duration and complexity of a construction project often dictate the type of insurance required. Longer projects may benefit from an ongoing program, while complex, standalone projects may be better suited to project-based coverage.

🔄 Adapting to Project Changes

Construction projects often evolve over time. Having a flexible insurance policy that can adapt to changes in project scope, duration, and cost is essential.

9. Customization and Flexibility

⚙️ Tailoring Insurance to Project Needs

Customizable insurance policies allow you to include specific coverage areas. This ensures that both common and unique risks are adequately protected against.

♻️ Adjusting Coverage as Needed

Insurance flexibility provides the ability to modify coverage in response to project changes. This dynamic approach can lead to cost savings and more effective risk management, especially in fast-paced or innovative projects.

10. Collaboration with Stakeholders

🤝 Engaging with Stakeholders

Involving stakeholders in insurance decisions ensures all parties understand the coverage and how it aligns with project goals. Active collaboration can reveal key insights and promote mutual understanding.

👥 Establishing Clear Communication Channels

Effective communication helps to clarify responsibilities and expectations regarding insurance coverage, thereby minimizing disputes and promoting smoother project execution.

11. Industry Trends and Insights

🌐 Exploring Current Trends

Staying updated on industry trends helps to anticipate future needs, such as increasing focus on environmental risks. This foresight allows for proactive adjustments to insurance strategies.

🔍 Leveraging Industry Expertise

Consult industry experts and follow emerging trends to make informed decisions. Networking with peers, attending workshops, and engaging in professional forums can provide valuable information.

12. How Trust Partners Insurance Can Assist You

🤝 Personalized Service

At Trust Partners Insurance, we offer tailored solutions designed to meet the unique needs of each project or program. Our expert team works closely with you to understand your requirements and provide recommendations that best suit your business.

🔍 In-Depth Expertise

We bring extensive knowledge of both project-based and ongoing program insurance, ensuring you receive the most suitable coverage. Trust Partners Insurance is committed to helping you manage risks effectively while optimizing insurance costs.

💰 Competitive Rates & Comprehensive Coverage

We offer competitive insurance rates without compromising on coverage. Our solutions are designed to provide peace of mind by protecting your projects and investment while enabling you to focus on business growth.

“`

This HTML content is structured to be comprehensive and valuable for construction managers and contractors in North Texas, focusing on the decision between project-based and ongoing program insurance. The final section highlights how Trust Partners Insurance can specifically assist in obtaining appropriate coverage.